Looking for tips related to financial planning and investment management?

3 Reasons Why Long-Term Investors Will Be Okay

Successful long-term investors invest through bear markets and recessions, not around them. In this week's video, Casey walks through our reasons for why we have so much conviction in long-term investing. Enduring short term market pain isn't easy. But if you can...

How Long Does it Take for the Stock Market to Bottom?

In this week's video Casey looks at how long **on average** it has taken for the stock market to bottom. Each market environment is different. But with everyone trying to "nail the bottom" it helps to have this context in mind. Our goal is not to try and time these...

What Should We Make of Conflicting Economic Data?

In this week's podcast, Tom and Casey discuss how the current economic data is telling two stories. We have historically low unemployment numbers but also historically high inflation, so what does that mean for everyday investors? The guys draw on historical examples...

Should You Downsize Your Home in Retirement?

Retirement is one of the biggest financial decisions you can make. It has far reaching implications across all areas of life. Another decision that often goes hand-in-hand with retirement is deciding whether or not to downsize your home. Most Americans believe that...

What Does Quantitative Tightening Mean?

There has been a lot of talk about the Fed's plan for quantitative tightening lately. But what exactly does that mean? And what should everyday investors expect? The Fed has been under the microscope so far in 2022 due to raising interest rates. But there is another...

Should You Contribute MORE to Your Investments When the Market is Down?

Contributing more to your investments when the market is down may seem like throwing good money after bad. But, for long term investors, it is exactly what you want to be doing. You're buying shares of investments at a lower cost.... which is a good thing, right?!...

An Update on Earnings and the Latest Economic Data

In this week's podcast, Tom and Casey summarize and provide context on the latest economic data. While also discussing several companies' recent earnings reports. They cover the following: Does a good company make a good stock? How is the Fed reacting to the latest...

How Does the Housing Market Impact Inflation?

Inflation has been one of the hottest topics of 2022 so far. Everyone wants to know when is it going to be controlled? In this week's video, Tom discusses the latest update on a key component of inflation... the housing market. Tune in to hear the latest and find out...

Why Everyone Needs an Inheritance Strategy

It's important to have an inheritance strategy in place BEFORE something goes wrong. Americans are living longer than before, which makes some folks believe they can put off planning for the inevitable. But do you really want to leave behind a mess and add to the...

The Financial Media Does Not Have Your Best Interest in Mind

The financial media does not have your best interest in mind. The people on TV know absolutely nothing about your personal financial situation. Please do not take what they say as investment advice. In this week's video, Casey explains 5 phrases the financial media...

The Problem with Getting Back in After Moving to Cash

We often talk about the mistake of making all-in/all-out investment decisions, like moving to cash. In this week's video, Casey talks about the other side of that decision, the decision of when to get back in. He covers the risk associated with waiting for an...

How Are Retirement Plans Affected by Down Markets?

In this weeks podcast, Brendan and Casey discuss how short term market losses impact retirement plans. They explain how to handle investment account distributions when markets are rocky and the importance of aligning your portfolio with your income needs. This is a...

How Much Should I Be Spending On This?

The best predictor of personal financial health is spending less than you make. Living below your means. But spending is different for everyone. And it is impossible to give prudent advice without knowing the context of the situation. Looking for external validation...

Are We Actually Heading Toward a Recession?

A lot of people are saying that we are heading toward a recession... but is that what's actually happening? In times like these it's crucial to not let our decision making be driven by the latest headlines. In this week's video Tom discusses signs in the stock market...

This is Why You Dollar-Cost Average

Volatile markets are the perfect time for investors to dollar-cost average into their investment strategy. In the last two weeks we've seen the stock market have violent moves in both directions. We've had two BIG up days that have been followed by more BIG down days....

What’s Going to Bring the Stock Market Back?

All the stock market headlines are doom and gloom right now. In this week's podcast Casey doesn't claim to have all the answers, but he aims to balance out that negativity by providing some facts and figures that have caught our eye here recently. He covers what tends...

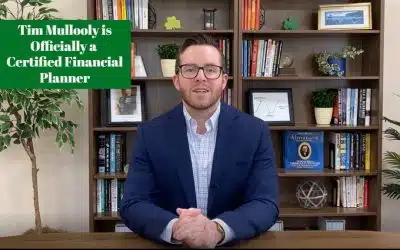

Tim Mullooly is Officially a Certified Financial Planner™

We're so proud to announce that our very own, Tim Mullooly, is officially a certified financial planner™! The CFP® designation is one of the highest achievements in our industry. In our latest video, Tim discusses how excited he is to apply the financial planning...

Trust Is Not For Sale

Financial planning is a living, breathing, relationship that's built on trust. Not some stale 30 page document that's going to change in 6 months. In this week's video, Casey speaks to our financial planning process and how it differs from the recent actions of...

2022 Capital Gains Tax Rates

Tom talks all things capital gains tax rates in this week's podcast. Now that 2021's tax deadline has passed, it's time to start looking for changes to make as we head further into 2022. He covers common misconceptions regarding capital gains taxes. As well as diving...

Is 2022’s Economy the 1970’s All Over Again?

There are a lot of comparisons being made between the current economy and the economy of the late 70's and early 80's. The guys discuss the similarities AND differences, while highlighting whether or not bonds still act as a diversifier and how to think about future...