Over the years we've fielded calls from people asking us different variations of this question: "I was offered an 8% guaranteed annuity by my insurance guy and wondered what you thought?". That's why Tom and Brendan decided to discuss high interest annuities on this...

Why Load Mutual Funds Don’t Make Sense

On this week's Mullooly Asset Management podcast, Tom and Brendan discuss why load mutual funds don't make sense. To explain what's wrong with load mutual funds, we must first make sure that everybody understands the difference between load and no-load funds. For...

Oil Crashing: Just Because of Fracking?

People are starting to notice that it costs less to fill up their car at the gas station, and it's due to the considerable drop we've seen in oil prices. A story line that's been circulating centers around US fracking and its devastating effects on the price of crude...

Exchanged Traded Managed Funds Approved by SEC

Back in September, Tom and Brendan discussed the industry push for nontransparent active ETF's (https://mullooly.net/nontransparent-active-etfs/7641). Today they update the situation as it's continued to develop. Eaton Vance received SEC approval to create an exchange...

Consistency is Key When Investing

Being consistent is a critical concept we must learn during life. Setting his recent and questionable financial advice aside, Tony Robbins has said that, "It's not what we do once in a while that shapes our lives. It's what we do consistently". This is 100% accurate....

Stock Market Seasonality

You've almost certainly heard the old stock market adage, "Sell in May and go away". It's existed for decades now, but a lot of investors have no idea where it came from. On this week's Mullooly Asset Management podcast, Tom and Brendan discuss this adage, the topic...

What Does Suze Orman Recommend?

On this week's Mullooly Asset Management podcast, Tom and Brendan discuss an article they recently read. Interestingly enough, the article came from Costco Connection magazine. Not the typical reading material of the Mullooly Asset Management team, but it was a good...

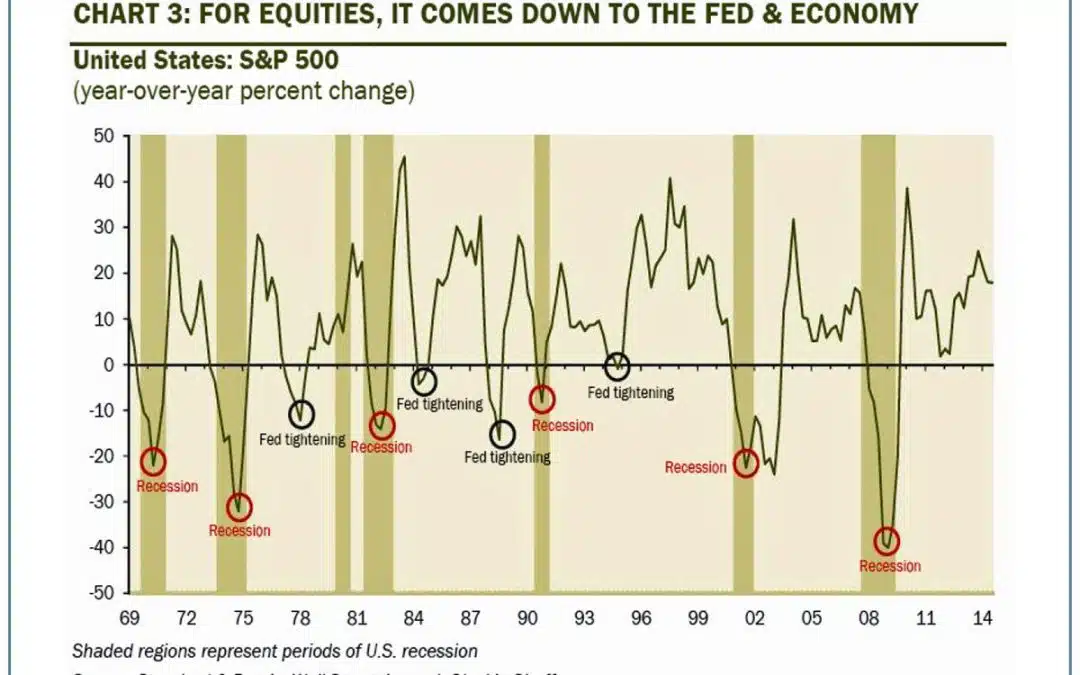

Two Underlying Causes of Bear Markets

With the volatility we've seen this October, Tom and Brendan took the opportunity to examine two underlying causes of bear markets. We experienced a near 10% peak to trough correction in the S&p 500 this month, but it's looking like we're going to finish the month...

Market Update: October 15th 2014

Tom and Brendan normally discuss big picture topics on the Mullooly Asset Management podcast. However, this week they decided that a market update would be best. The current market volatility is what's on everybody's mind. Markets moved lower at the open today. The...

The Current Relative Strength of Small Caps

The small cap swoon has continued into October and we’ve repeatedly heard advisors, the financial media, investors, and clients ask, “Is the run in small caps over?”. If you’d like our opinion at Mullooly Asset here it is: maybe. Not the answer you were looking for?...