Listen to our latest podcasts

Get the latest resources on money topics that matter.

Dow Jones Industrial Average Celebrates 119th Birthday

Yesterday the Dow Jones Industrial Average celebrated its 119th birthday! Charles Dow and Edward Jones created the index, and it was first calculated on May 26, 1896. While the Dow Jones Industrial Average is certainly the most discussed US market index, you may be...

Relative Strength Buy Signals

A topic we can't seem to discuss enough here at Mullooly Asset Management is relative strength. Relative strength refers to the momentum factor. As John Lewis, CMT of Dorsey Wright Money Management described in a recent whitepaper: Relative Strength (momentum)...

Group Annuity Products: An Expensive Way to Invest

At Mullooly Asset Management, we help a lot of individuals manage their retirement accounts at work. The type of retirement account doesn't matter (401k, 403b, or 457), we advise individuals on how to allocate their retirement savings within these plans. Sometimes, we...

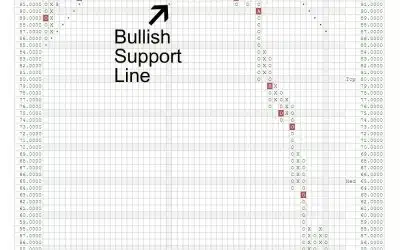

Understanding Peer and Market Relative Strength

Our portfolio management strategy at Mullooly Asset Management has two main parts: point and figure charting and relative strength. Relative strength is also referred to by academics as the momentum factor. To put it plainly, relative strength (or momentum) is...

Work for Longer or Save More Aggressively?

Time is said to be our most valuable asset, so if you're behind on saving for retirement, just work longer! Sounds simple enough, right? While this theoretically seems like a great solution, it isn't so easy in the real world. Nobody likes to hear this, but the best...

Not Having a Plan Means Not Knowing Yourself

It's been said that, "A goal without a plan is just a wish". This applies to personal finance, as well as many other aspects of life. Most people wish that they could stop worrying about their finances so much, but they have no plan to achieve that goal. When it comes...

Roth IRA or Roth 401k?

Here at Mullooly Asset Management, we help a lot of individuals manage their retirement accounts at work. In doing so, we've taken a look at countless 401k's, 457's and 403b's. Within many of these employer sponsored plans, a Roth option is offered. I've noticed some...

Term Life Insurance vs. Whole Life Insurance

If you've looked into buying life insurance before, there's a good chance you've heard the adage, "Buy term and invest the difference". We do not sell insurance at Mullooly Asset Management or hold ourselves out to be insurance experts. However, we do help our clients...

We Can’t Predict Your Retirement Age

On this week's podcast Tim and I discuss why we're incapable of telling people what age they'll be able to retire at. This might be disappointing to hear, but it's the truth. We aren't able to predict what age you'll be able to retire at or how much money you'll need...

Foundations of Our Strategy: Point and Figure Basics

At Mullooly Asset Management, one of the foundations of our strategy is point and figure charting. Point and figure charting is a type of technical anaylsis that tracks security prices through columns of X's and O's. People successfully use other types of technical...

Maybe You Shouldn’t Be Maxing Out Your 401k (Yet)

It may not always be appropriate to max out your 401k contributions. That's right, Tom and I make the case for not maxing out your 401k contributions on this week's Mullooly Asset Management podcast. Probably not what you were expecting to hear, right? Let me preface...

Why Increased Job Creation Hasn’t Inspired More Spending

We've definitely seen an increase in job creation recently. This is generally a good economic sign: more jobs being created means consumers are more willing to spend money, thus stimulating the economy. We haven't seen this lately though, leaving many to wonder what's...

Are You Saving or Investing?

"I'm saving for a down payment on a home." "I'm saving for my child's college education." "I'm saving for retirement." These are three very different goals, yet all have been deemed "saving". Not to get picky, but there's a big difference between saving and investing....

Being Realistic About Time Horizons

One of the most frequently quoted time periods in finance is the ambiguous "long term". We're all supposed to be long-term investors, and studies show that "over the long term" results will be desirable. This sounds nice, but what is this mythical "long term"? Is...

Fee-Based Advisors: Working for You or Their Firm?

"Fee-based...fee-only...same thing, right?". We've heard this before, and if it sounds correct to you then the brokerage industry's obfuscation has succeeded. Just last week, Tom and Brendan discussed why you need to ask how your advisor is compensated. With so many...

Exchange Traded Notes (ETNs): Know What You Own

The SPDR S&P 500 ETF (SPY) began trading in January of 1993. That was the first exchange traded fund, and we've seen quite the evolution since then. Flash forward 22 years and ETFs have become a market fixture. From ETFs we've seen another exchange traded product...

Bad Things Happen in Negative Trends

Here at Mullooly Asset Management we use a form of technical analysis called point and figure charting to manage investments. In point and figure, one of the main purposes the chart has it to help us identify trends. Whether we're looking at a stock, index, mutual...

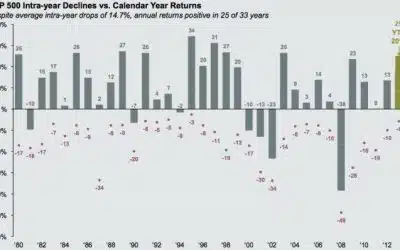

Even in Good Years the Market Pulls Back

Keeping things in perspective is important. Investors fall victim to cognitive biases sometimes, but we can do our best to avoid that type of behavior. With the strong markets seen in 2012, 2013, and 2014, investors are primed for recency bias to cloud their...

Even the S&P 500 Changes Holdings

According to many market experts, investors should buy and hold always and forever, right? If you've been told that before you might be surprised to learn that even the S&P 500 changes its holdings every so often. In fact, according to a recent Business Insider...

Avoiding Cognitive Biases: The Disposition Effect

On this week's Mullooly Asset Management podcast, Tom and Brendan discuss a cognitive bias known as the disposition effect. Cognitive biases such as the disposition effect, loss aversion, confirmation bias, and others can negatively affect investment performance. Tom...