Listen to our latest podcasts

Get the latest resources on money topics that matter.

Tim’s Top Links – 2/1/19

Just as everyone expected, the worst December's for stocks was followed up by the best January's for stocks! We all knew that was going to happen...right? Just a nice reminder that the market humbles even the best of investors every once in a while. Let's have a...

Ep. 241: Retirement and the Sequence of Returns

In Ep. 241 of the Mullooly Asset Podcast, Brendan and Tom talk about the sequence of returns in the market and how they can positively, or negatively, affect your retirement. They tie in some baseball history and talk MLB free agency as well! Enjoy! Ep. 241:...

Ep. 240: Pay Attention to Cash Flows in 2019!

In Ep. 240 of the Mullooly Asset Podcast, Tim and Brendan talk about a few articles that circle around probably the most important topic in personal finance: cash flows! With the government shutdown affecting hundreds of thousands of people, it's a great time to...

Ep. 239: Tax Withholding, Budgeting, & Tips for 2019

In Ep. 239 of the Mullooly Asset Podcast, Brendan and Tom talk about important topics for the start of 2019. They discuss the importance of checking your tax withholding each year, the importance of paying yourself first, and how to determine what to prioritize in...

Ep. 238: Understanding Gold, No Bond Apocalypse, Credit Card Points

In Ep. 238 of the Mullooly Asset Podcast, Tom and Brendan break down a couple key topics to start the new year. First off, they discuss the importance of understanding what gold does in relation to the stock and bond markets. Second, they address how certain bond...

Ep. 237: Putting 2018 in Perspective

In Ep. 237 of the Mullooly Asset Podcast, Brendan and Tom put the year of 2018 into perspective. Using a couple of great articles from Charlie Bilello and Ben Carlson, they take what happened in the market this year and place it alongside a handful of previous years...

Ep. 236: The Fed Impact

In Ep. 236 of the Mullooly Asset Podcast, Brendan and Tom talk about the Fed. With the Fed being in the news a lot lately, they break down what the real purpose of the Fed is, what it has done over history, and the different impacts it has had on the market over the...

Ep. 235: 2018 Market Volatility, Credit Card Debt, Bernie Madoff

In Ep. 235 of the Mullooly Asset Podcast, Brendan and Tom break down the volatility in the market in 2018. Historically, this year has been more in line with "normal" volatility than last year. They also discuss paying off credit card debt, and re-visit the Bernie...

Ep. 234: Outperforming Cash, 2018 Gains/Losses, Tax GAIN Harvesting

In Ep. 234 of the Mullooly Asset Podcast, Tom and Brendan discuss a number of important topics. They talk about tax gain harvesting, what to do when cash outperforms everything else, and how mutual funds are doing coming into the end of 2018. Show Notes 'When Cash...

Ep. 233: Amazon, Bitcoin, & the Holiday Season

In Ep. 233 of the Mullooly Asset Podcast, Tim and Tom break down a few articles that are very timely for the holiday season. They talk about Amazon and retailers during the holidays, Bitcoin conversations, and what it means to keep things in perspective over the...

Ep. 232: Active Share, 2019 Contribution Limits, 401(k) Millionaires

In Ep. 232 of the podcast, Brendan and Tom talk about a few interesting articles they read recently. They also talk about the article that featured Brendan in The New York Times last week discussing 401(k) contribution limits for 2019. Enjoy! Show Notes 'MYTH:...

Ep. 231: Back Into the Market, Tax Loss Selling, & What is Smart Beta?

In Ep. 231 of the Mullooly Asset Podcast, Tim and Brendan break down a few interesting articles from the past week. They talk about the psychology of getting back into the market after moving to cash, why tax-loss selling always seems to take place in December, and...

Ep. 230: Working Longer, Retirement Plans, & Market Downturns

In Ep. 230, Brendan and Tom talk about a couple of important topics. They discuss how simply planning to "work longer" isn't always a sure-fire way to plan for retirement savings. Being able to work longer is sometimes out of the individual's control. They also...

Ep. 229: The ‘Good Old Days’ that Never Existed: Revamping 401(k)s

In Ep. 229 of the Mullooly Asset Podcast, Brendan and Tom reminisce about the 'good old days' when everybody had pensions and 401(k)'s and everybody was happy! And then they burst everyone's bubble reminding people that didn't happen! They talk about these workplace...

Ep. 228: Fund Managers, Active Mutual Funds, & Capital Gains

In Ep. 228, Brendan and Tom talk about a few articles and podcasts that caught their eye this week. They talk about the ever-changing roles and incentives for active mutual fund managers, the way capital gains distributions in mutual funds can cause huge tax bills,...

Ep. 227: Millennials, Minimizing Student Loans, Warren Buffett

In Ep. 227 of the Mullooly Asset Podcast, Tim and Tom break down some headlines from this week. They discuss why Millennials are afraid to invest their money and prefer cash, how to potentially talk to your children about ways to reduce student loans, a witty quote...

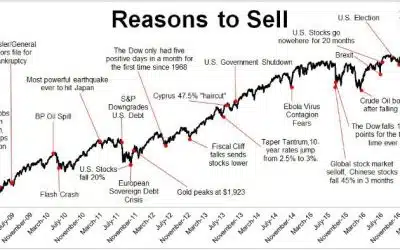

Ep. 226: “Reasons to Sell” Since 2009

In Ep. 226, Brendan and Tom talk about a chart posted last year by our friend Michael Batnick of Ritholtz Wealth Management. The chart shows "reasons to sell" over the last decade, and looking back on them they feel somewhat foolish. However, in the moment it's...

Ep. 225: Tesla, Crypto Scams, & Monthly Bills

In Ep. 225 of the Mullooly Asset Podcast, Brendan and Tom breakdown some headlines from this week. They talk about Elon Musk considering taking Tesla private, Facebook trying to team up with banks, cryptocurrency "pump and dump" schemes, and auditing your own monthly...

Ep. 224: Is it Time to Revamp the 401(k)?

In Ep. 224 of the Mullooly Asset Podcast, Brendan and Tom break down a recent article from the Wall Street Journal that talks about auto-enrollment rates for 401(k) plans. This leads to a bigger discussion about the 401(k) plan as a whole, and the purpose of the...

Ep. 223: Financial Questions, U.S. Pension Trouble, Saving Too Little

Show Notes 'The Most Googled Financial Questions By State' - Think Advisor 'The Pension Hole for U.S. Cities and States is the Size of Japan's Economy' - The Wall Street Journal 'What Should You Do With Your Home Equity in Retirement?' - Christine Benz - Morningstar...